Copy Trading is basically a way to let amateur traders, or complete beginners, automatically copy the trades of more experienced traders. Also sometimes known as 'mirror trading' or 'auto trading', it lets you browse through the profiles of experienced traders and see their trading statistics. When you find one you like, it lets you set your account to automatically copy all of their future trades.

How Copy Trading Developed

Let's go back a bit. In the past, if you wanted to invest you had to find a 'broker' who you'd pay commission to make trades on your behalf. The trades could be buying or selling stocks and shares in companies, or a range of other investments.

You could either tell the broker what to buy, take their investment advice, or just let them trade for you. This is how things worked for a long time. Trading was a closed world in many ways, and brokers acted as its gatekeepers. The rest of us just looked on as a small section of elite society seemed to be making a lot of money in the financial markets.

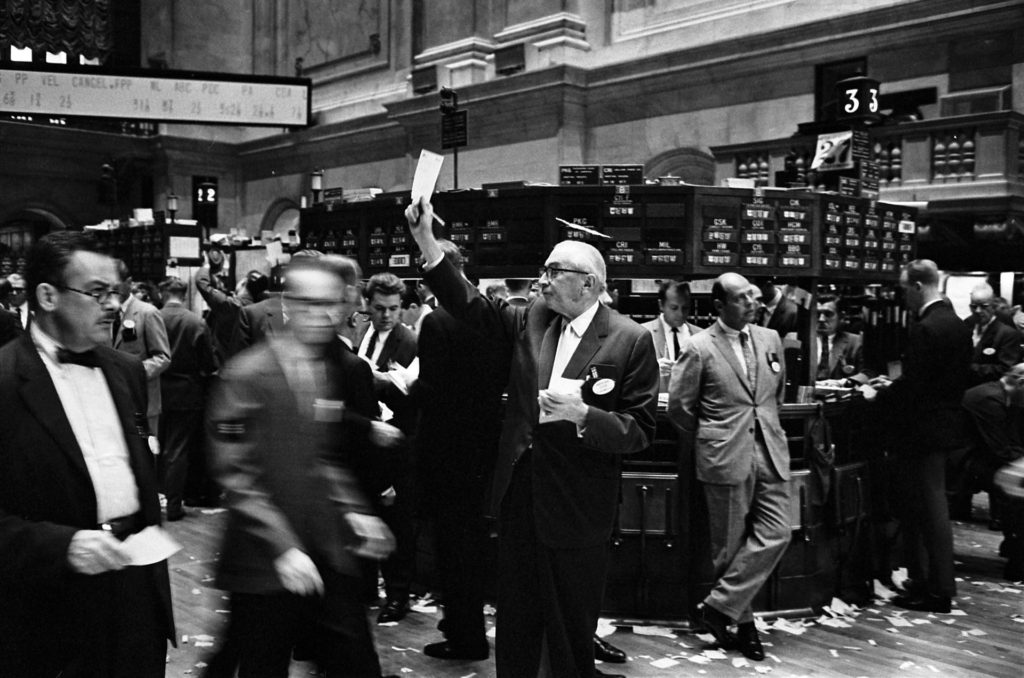

Trading Floors and Strange Charts

The other traders we saw were all busy yelling at each other in strange rooms and staring at numbers on boards. Trading Places was a great film, but really didn't help us all feel like we could belong there. As times moved on, we saw lots of computers, and incomprehensible charts. Things had changed, but they hadn't gotten any simpler. Why has that guy got 6 computer screens!?

The Evolution of Trading Technology

From the old trading exchange floors to the sleek glass offices was quite a jump. Computers had won, and everything went digital. The internet appeared, and trading floors were on the wane. The old shouting and yelling in the big trading pits of New York, London and Chicago were replaced by computers processing information at unimaginable speed, and traders around the world glued to their screens. Trading was still trading, and people won and lost fortunes on the money markets.

Social Media Arrives

In an unrelated development, faster internet speeds and better websites facilitated the rise of social media, and it didn't take everyone long to get on board. Within a decade, social media became an integral part of daily life. We know what someone's 'profile' is, how to 'follow' them or 'comment' on something — we understand building digital relationships and having everyone in one big communal digital space.

Social Trading is Born

As soon as we were all used to social media, someone had the bright idea of combining the features of our favourite social sites with classical trading, letting everyone join the trading community. It was never possible before — the technology just didn't exist. And now, the closed world of trading was made wide open, and 'Retail investors' (as opposed to professional investors) started to take note of this sudden access to the playground of the rich.

Copy Trading Arrives

Copy trading takes everything a step further. As non-professional investors flooded into the market, someone had the bright idea of letting newer investors 'copy' the trades of more experienced investors.

They gave everyone the ability to see each other's statistics. They made the charts simpler, made it possible to see how risky someone's trading was, how much they'd made since they started trading on the site — month by month. We could see what everyone was trading, and read their posts about why they traded like they did.

Making it Friendly

In short, they made it easy to go shopping for a talented trader. And when you find one, they put a big friendly 'Copy' button, so that you could easily choose to set your account to automatically copy all of that person's future trades.

When they buy, you buy. When they sell, you sell. Fully automated — you don't have to do a thing. You can go on about your daily business, and someone's trading on your behalf. You choose how much you want to copy them with, and that's how much of your money they will be trading with.

If you lose a certain amount (whatever you specify), the system will automatically stop copying that person for you and the remaining money goes back into your trading account. And there's no charge to copy someone — the website gives them incentives the more people copy them.

Does Copy Trading Actually Work?

On eToro, you pay the normal spread fees for each trade, and there are other fees to be aware of. The people you copy are called "Popular Investors". If you think you're good enough at trading and would like to give it a try, you can sign up to their Popular Investor program.

It's still trading, so assets can go either up or down in value. Learning to pick the right investors takes a little time, but all their statistics and history are there in full view.