The idea of copy trading is to make money. It's great that the technology is clever and the platform looks good, but what about profits? How much will you actually make? We all want some cold hard facts — so let's go through it honestly.

It Depends Who You Copy

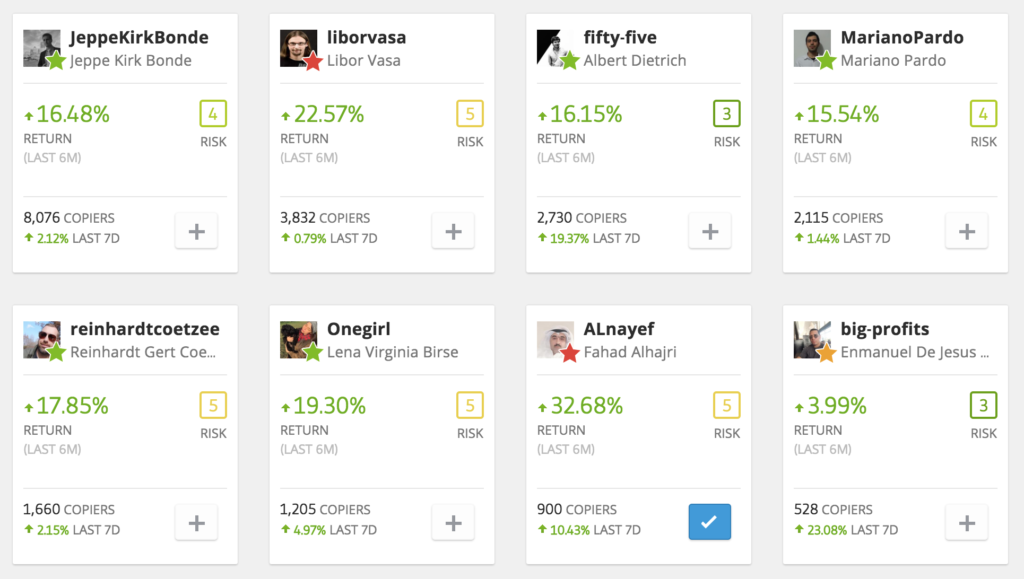

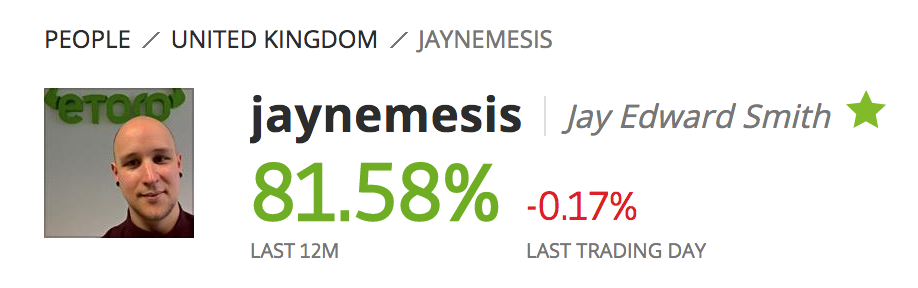

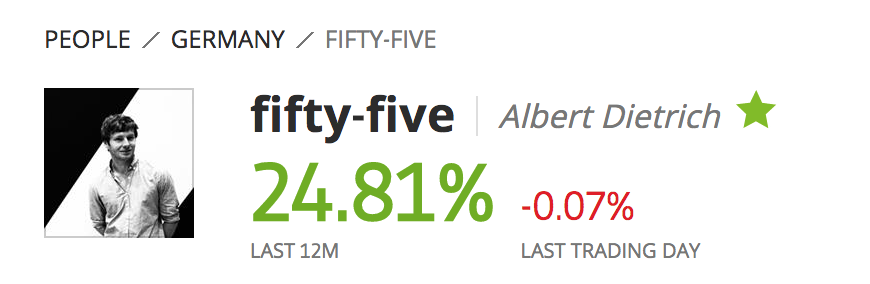

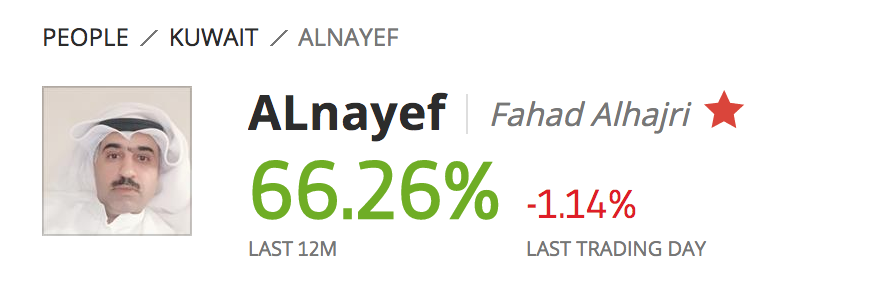

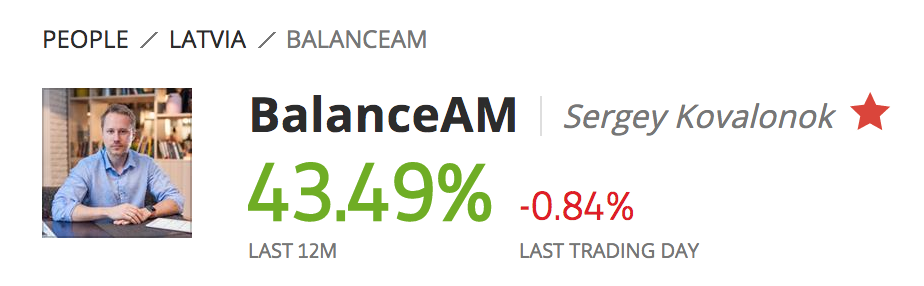

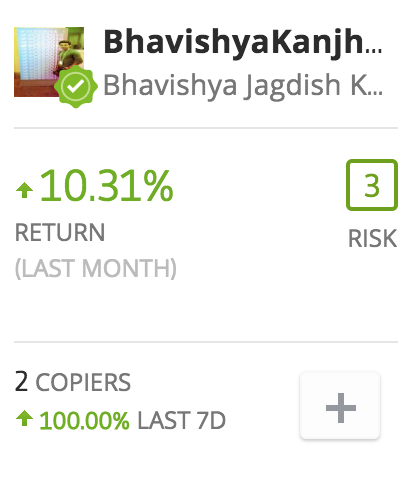

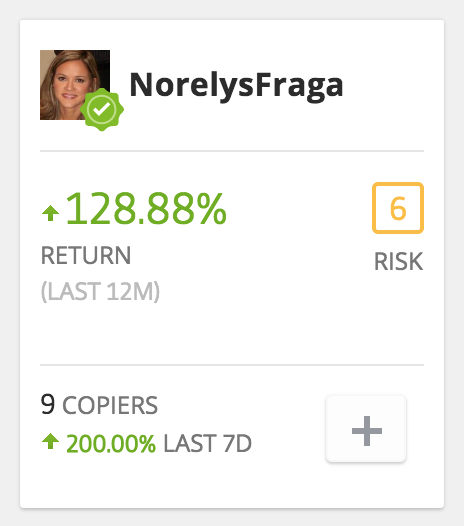

When you copy trade, you're choosing to automatically copy the trades of another person. Obviously, all people are different and make different choices and decisions. One trader might make 60% profit in a year, another 30%, another 120%, and yet another might have made a 20% loss over the same timeframe. There are no guarantees.

Why Are Profits Shown as Percentages?

A really important thing to understand is that when you're talking about trading, results are always shown in percentages. "Trader A made 6% this month." You'll always hear about profits and losses in terms of percentages. Why?

It's because we can't see how much actual cash each person is trading with, but it doesn't matter — we see how effective they are at trading through their percentages. The amount of money you copy them with is the other part of the story.

Working it Out — A Simple Example

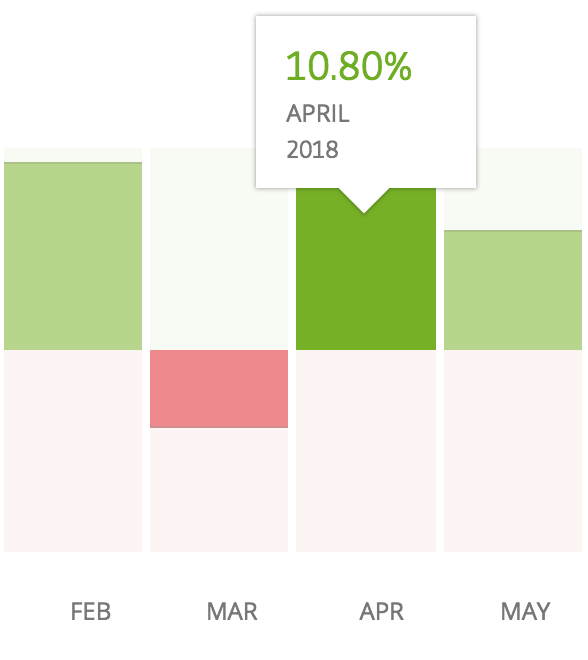

Let's take 'Trader A' as an example. Over the next month, Trader A makes a 10% profit. You are currently copying Trader A — so how much actual money will you make?

It depends how much money you copy them with:

- If you copy Trader A with €200, you will make 10% of €200 = €20

- If you copy Trader A with €1,000, you will make 10% of €1,000 = €100

- If you copy Trader A with €5,000, you will make 10% of €5,000 = €500

It's a very simple idea, but unless you're familiar with it, it takes a little getting used to. Once you do, it all becomes much simpler. The formula is: Money copied × Trader's % return = Your profit (or loss).

Note that this works both ways — if they lose 10%, you lose 10% of whatever you have copied them with too.

Risk and Reward

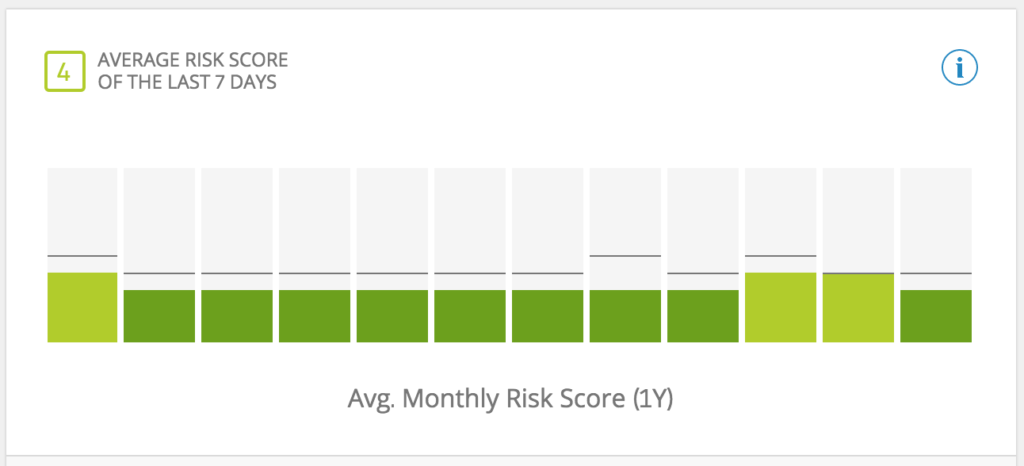

Naturally, because I was trying to make money, I started looking for higher-risk traders who could make higher returns. I learned to watch out for this.

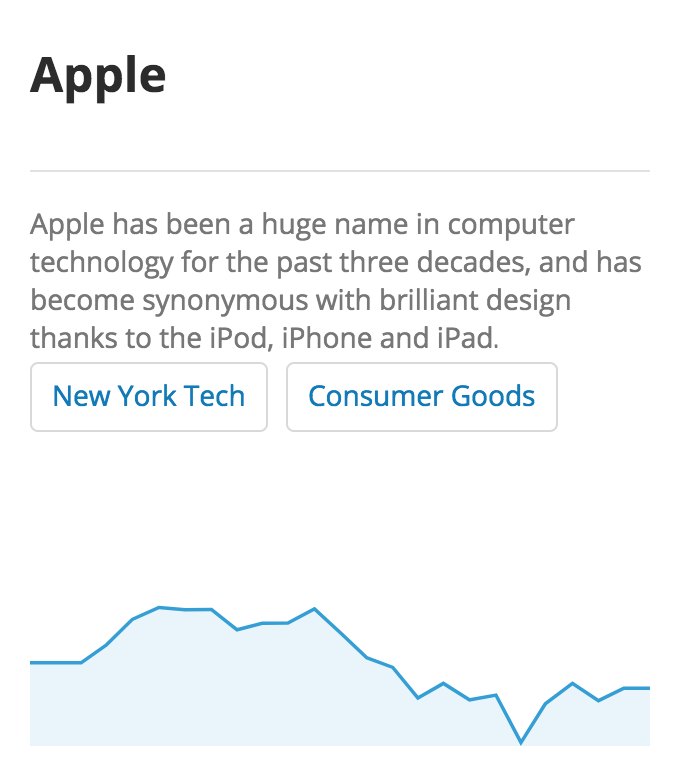

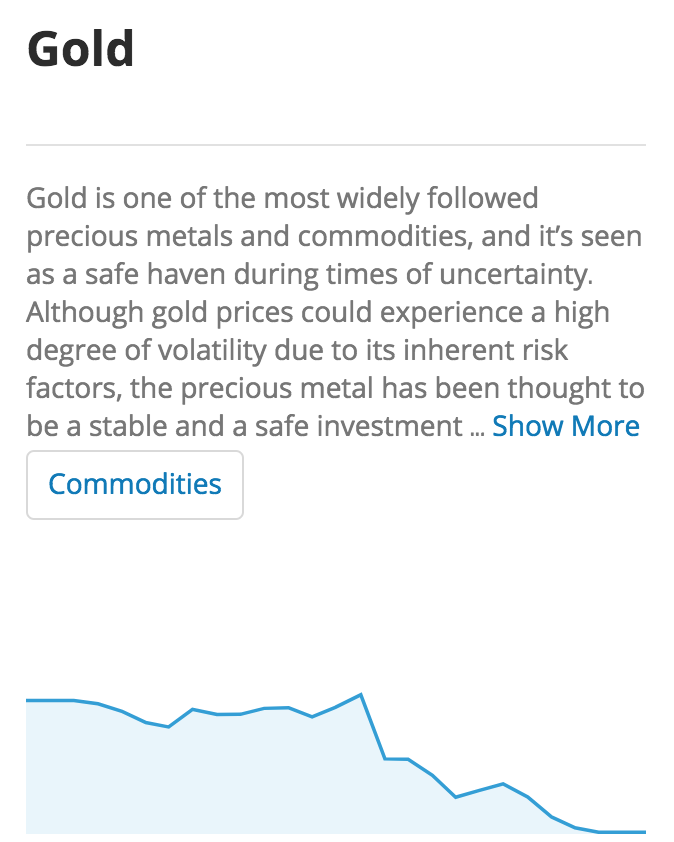

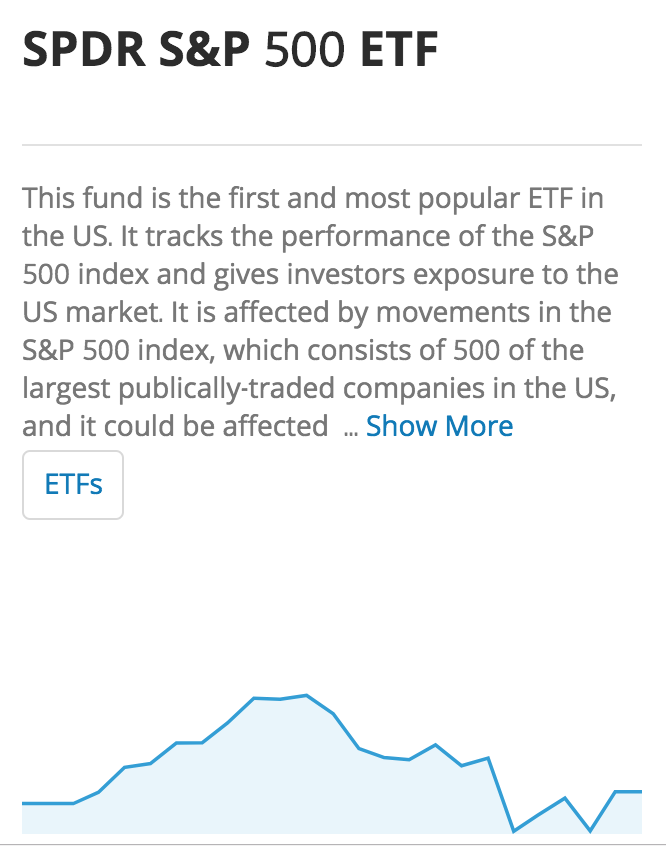

If I'm copying Trader A, if he makes 5%, I make 5%. It's also true that if he loses 5%, I lose 5% of whatever money I have copied them with. Whenever people trade, they are betting on the future price movement of an asset — it could be a share in Apple, the price of Gold, or the price of Bitcoin.

Volatility

In trading, an asset can be described as more 'volatile' or less 'volatile' — meaning how often it has big swings upwards or downwards in price. The bigger the swings, the more it is described as a 'volatile' asset. If the price moves in a big way, it means you can potentially win or lose more money. 'Risk' and 'reward' are closely linked.

Leverage

There are methods in trading which also increase your risk. The biggest is 'leverage' — basically a way of amplifying your trade, so that if you are trading with $100, you can apply 10x leverage and it's as though you're trading with $1,000. Potentially you make a lot more money. Potentially you can also lose a lot more money. Leverage increases both potential wins and potential losses significantly.

What Does This Mean for Copy Trading?

When I started looking for traders to copy who could make more than 5% per month, I soon realised that in order to make huge profits each month, some traders were using more risky methods. If I copied them, I would also be exposing myself to more potential losses as well as the potential profits I was after.

This is a question each person has to decide for themselves: how much risk do I want to take on in search of profits? How much can I genuinely afford to lose?

My Own Experience with Risk

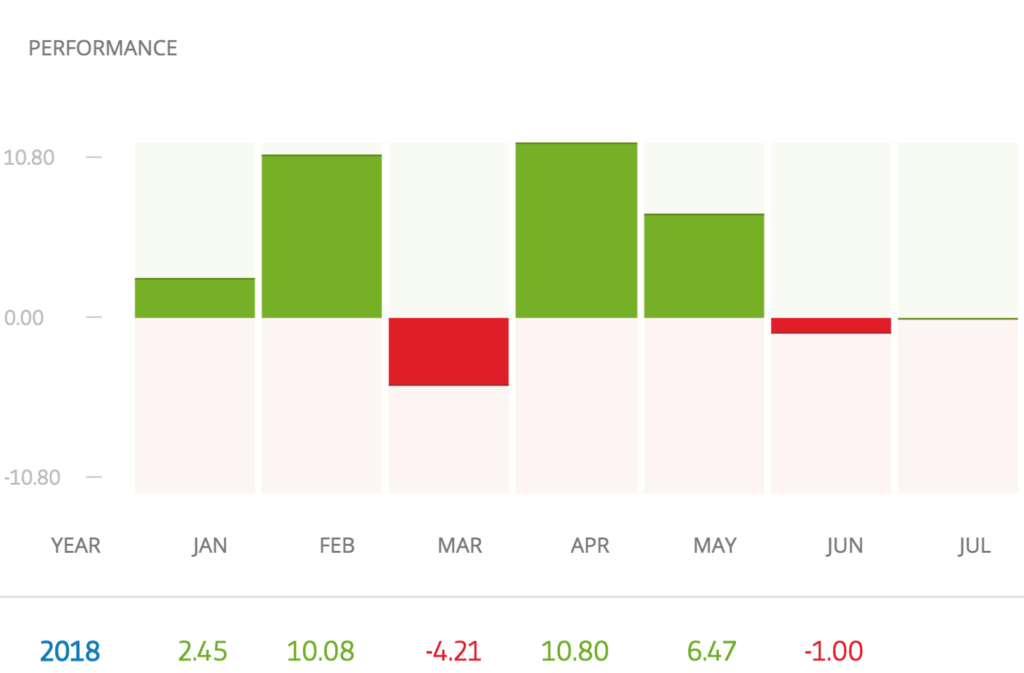

I started pretty low-risk, then got attracted to the higher rewards of crypto traders and assumed that because cryptos were going up all the time there was a lot of reward with very little risk. But where there's potential for great rewards, there's always the potential for great risks — as I saw when the crypto markets took a downturn in early 2018.

Now I'm looking for traders who have made good percentages of profit over the last year or two, but who also show the clear ability to keep their risk levels low. It's a good trade-off, and hopefully will work long term without my hair going grey overnight.

Setting Realistic Expectations

I now know that it's hard to make £1,000 per month when you only have £1,000 or £2,000 to invest. It would mean going after very risky traders, and it might work, but you'd be statistically much more likely to lose your money. A more realistic goal is steady, moderate growth from traders with a solid, consistent track record.