CopyTrading Profits

The idea of copytrading is to make money. It's great that the technology is clever, and the site looks so good, but what about profits? How much will I make? We all want some cold hard facts.

It depends who you copy

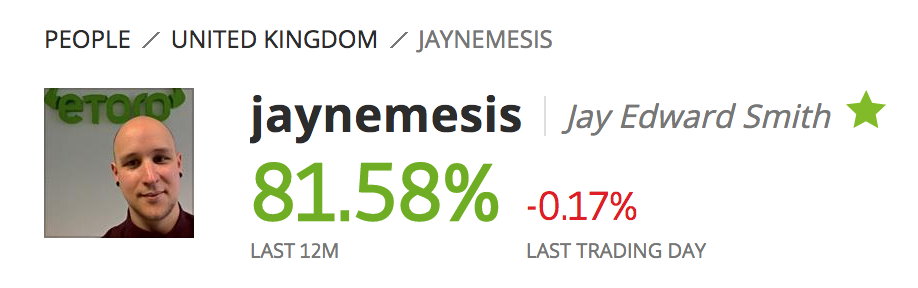

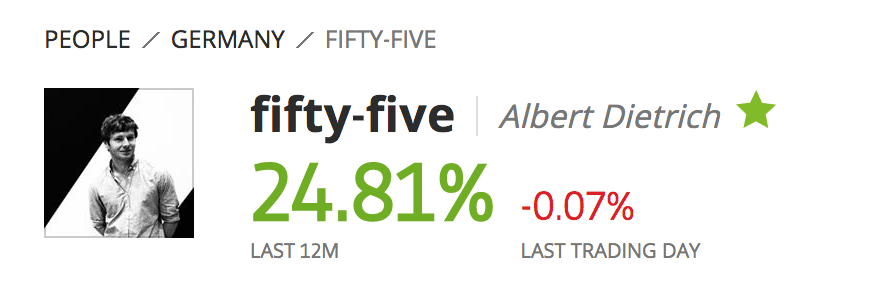

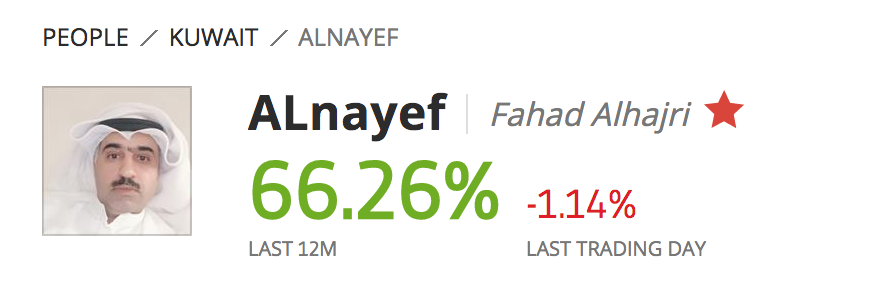

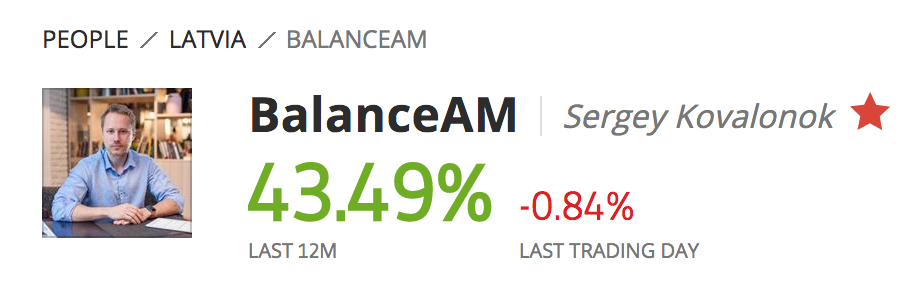

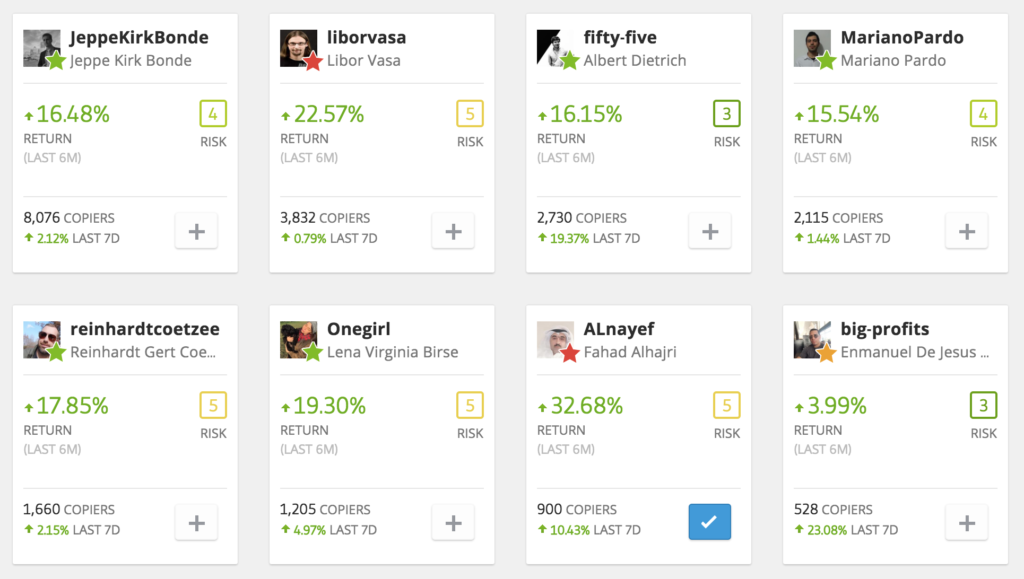

When you copytrade, you're choosing to automatically copy the trades of another person. Now, obviously, all people are different and make different choice and decisions. One trader might make 60% profit in a year, another 30% profit in a year, another 120%, and yet another might have made a 20% loss over the same timeframe.

Have i made money copytrading?

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Why are you talking about percentages of Profit?

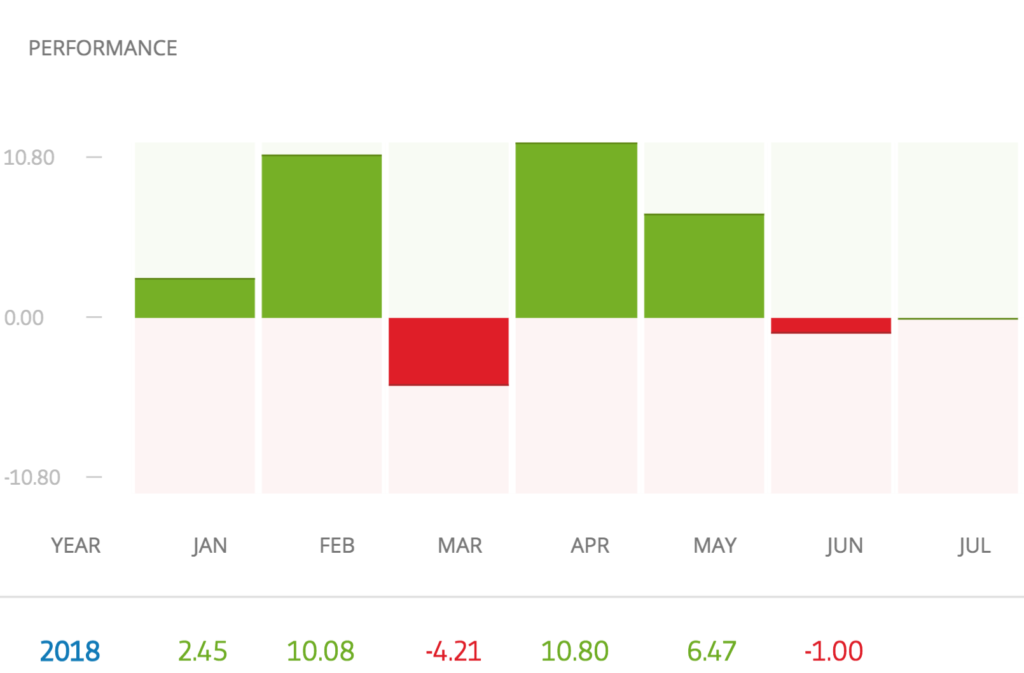

A really important thing to understand is that when you're talking about trading, they always show each trader's results in percentages.

"Trader 'A' made 6% this month"

"Trader 'B' made 13% over the last 3 months"

"Trader 'C' made 120% last year"

You'll always here about profits and losses in terms of percentages. Why is that?

It's because we can't see how much actual cash each person is trading with, but it doesn't matter - we see how effective they are at trading through viewing their percentages. The amount of money we copy them with is the other part of the story...

Working it out

Let's take 'Trader A' as an example.

Over the next month, Trader A makes a 10% profit.

I am currently copying Trader A, so how much actual money will I make by the end of next month?

It depends how much money I copy Trader A with...

If I copy Trader A with €200, then I will make 10% of €200, which = €20.

If I copy Trader A with €1000, then I will make 10% of €1000, which = €100

You see, the percentage Trader A made was the same in both instances. They made 10%. How much profit I make in cash depends on mixing how much profit they made in %, and how much cash I actually copied them with.

It's a very simple idea, but unless you're familiar with it, it takes a little getting used to. Once you do, it's all much simpler. It's a simple multiplication:

Money you copied them with (multiplied by) percentage of profit or loss they make while you're copying them.

Risky Business

Naturally, because I'm trying to make money, I started looking for higher risk traders who could make me higher returns. I learned to watch out for this...

Can I find traders who make more than 5% per month, so I can make more profit with less money invested?

This is when we need to start looking at what "Risk" is in trading...

Risk - it's closely tied to reward...

If I'm copying Trader A, if he makes 5%, I make 5%. It's also true that if he loses 5%, I lose 5% (of whatever money I have copied them with.)

Whenever people trade, they are betting on the future price movement of an asset.

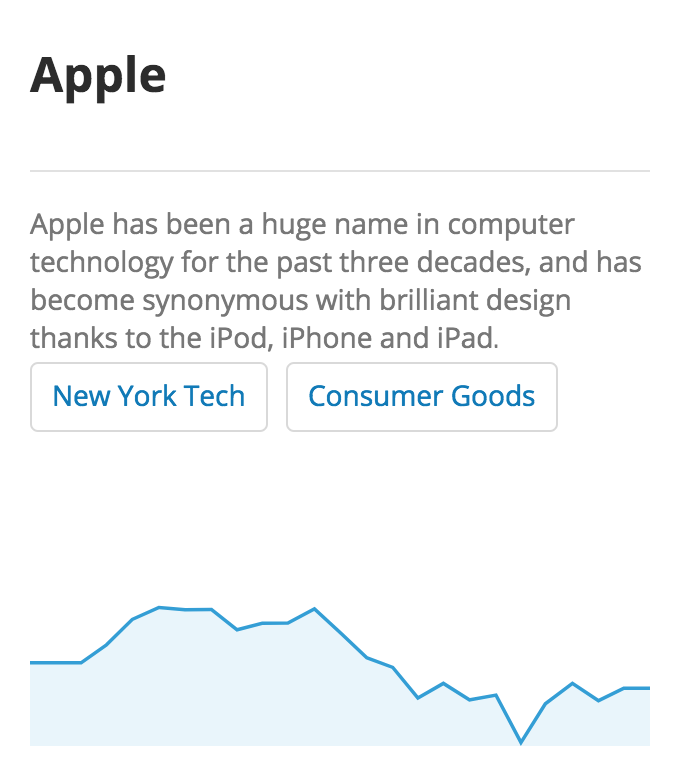

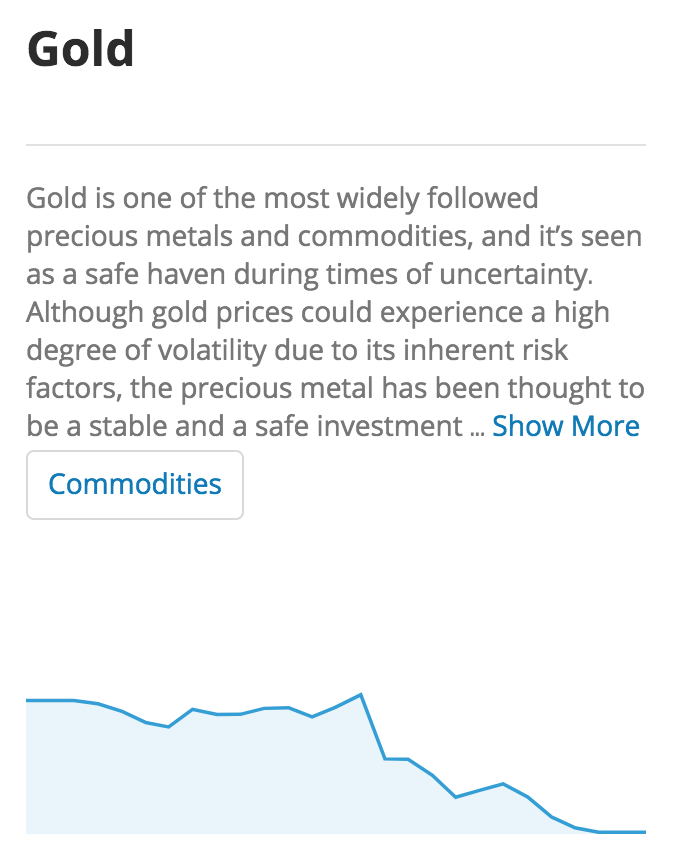

It could be a share in Apple, or the price of Gold, or the price of Bitcoin. It doesn't matter what the asset is, they're trying to predict whether the price will go up or down.

Volatility - It's what makes us money

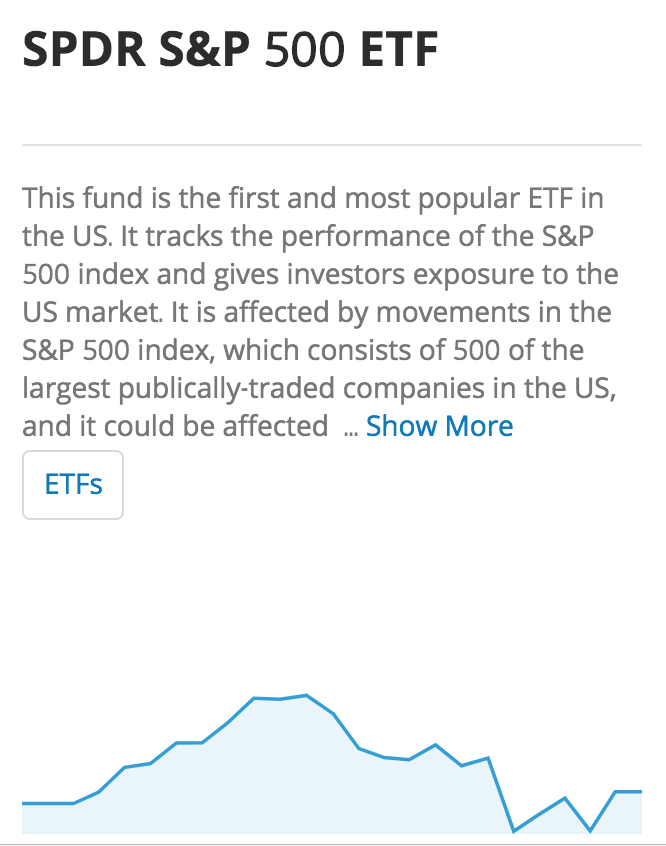

In trading, an asset can be described as more 'volatile' or less 'volatile'.

When they talk about 'volatility' they mean how much the asset often has big swings upwards or downwards in price. The bigger the swings, the more it is described as a 'volatile' asset. Different assets have different amounts of volatility.

Now, if the price moves in a big way, it means you can potentially win or lose more money trading that asset. In that way, it carries more 'risk'. 'Risk' and 'rewards' are closely linked in trading.

So, if you go after bigger rewards, you expose yourself to bigger risks at the same time. It's always the way.

There are other methods in trading which also increase your 'risk'. The biggest of these is using something called 'leverage' which is basically a way of amplifying your trade, so that if you are trading with $100, you can apply 10X 'Leverage' and it's as though you're trading with $1000.

Potentially you make a lot more money! Potentially you can also lose a lot more money too... If you increase the risk, you increase the potential for wins AND losses.

What does this have to do with Copytrading?

When I started to look at my earlier option A - to find traders to copy who could make more than 5% per month, I soon realised that in order to make huge profits each month, some traders were using more risky methods. If I copied them, I would also be exposing myself to more potential losses as well as the potential profits I was after. This is a question each person has to decide on for themselves. How much risk do I want to take on in search of profits? How much can I genuinely afford to lose?

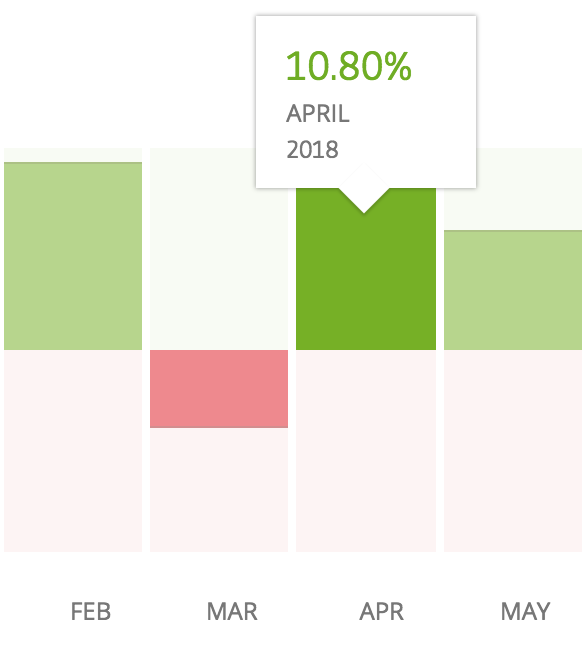

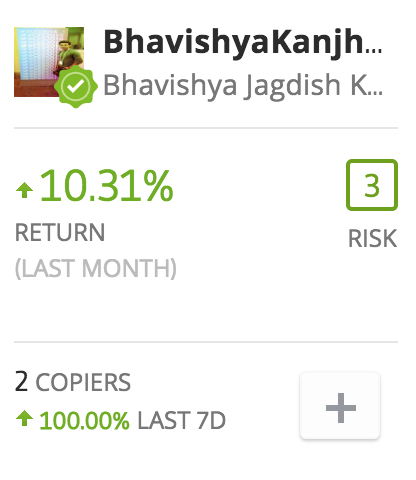

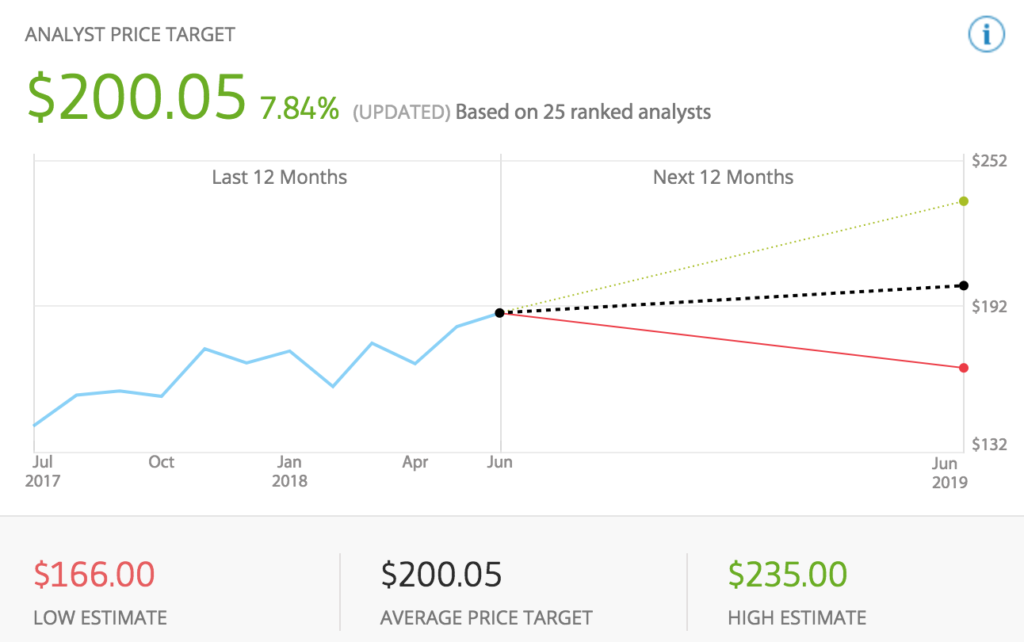

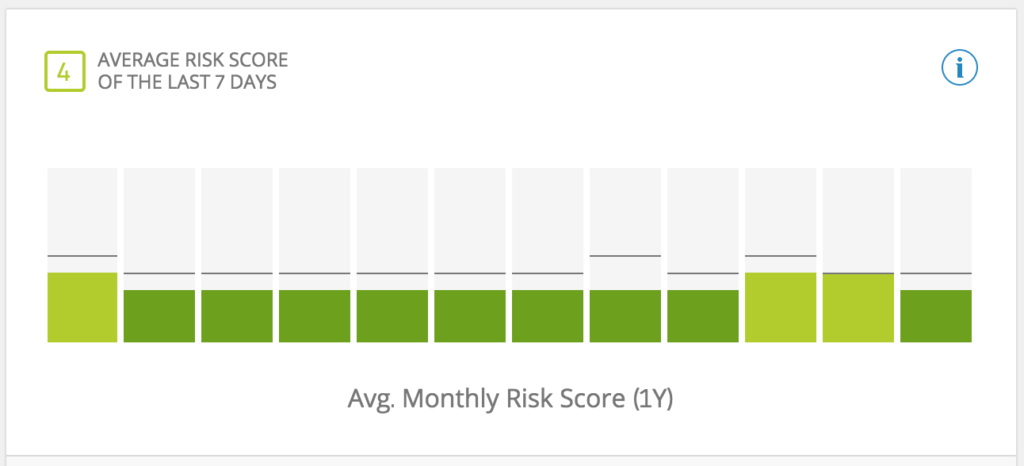

In the beginning, I was looking for a balance of profit and low 'risk scores' (you can find charts showing each trader's risk scores over the last year / month in their profile - it's a simple way to see how risky their trading style is.) I stayed pretty low-risk at for a while...

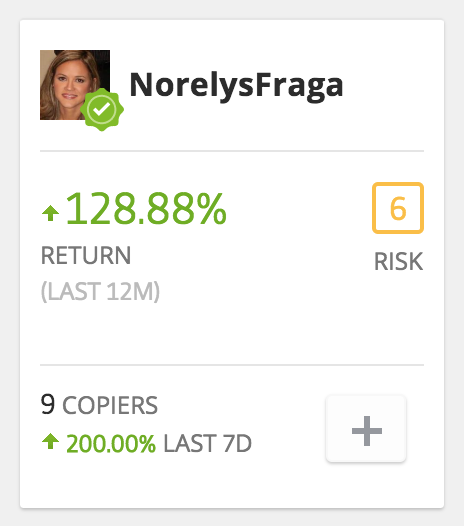

Then I got attracted to the higher rewards of the crypto traders, and assumed that because cryptos were going up all the time, there was a lot of reward with very little risk... But where there's potential for great rewards, there's always the potential for great risks as I saw when the crypto markets took a downturn in early 2018.

Does that mean I'm going to stay away from anything risky?

Of course not! What it means is that I'm learning more about balancing my desire for profits with my need for security and not have too much risk.

Will I sometime miss out on big profits because of this?

Yes, probably, but I'll also miss out on some big losses too! My goal now is to copy a more balanced range of people, so that there's a more steady increase with out all the big spikes and dips which come with copying the very risky traders.

I haven't lost faith in cryptos...

So 'Option B' won? Lower your expectations of profit?

In a way, yes - I now know that it's hard to make $1000 per month when I only have $1000 or $2000 or $3000 to invest. It would mean going after very vert very risky traders, and it might work, but I'm statistically much more likely to lose my money, which I really don't want to do.

So now I'm looking for traders who have made good percentages of profit over the last year or two years, but who also show the clear abaility to keep their risk levels low. It's a good trade-off, and hopefully will work long term without my hair going grey overnight...